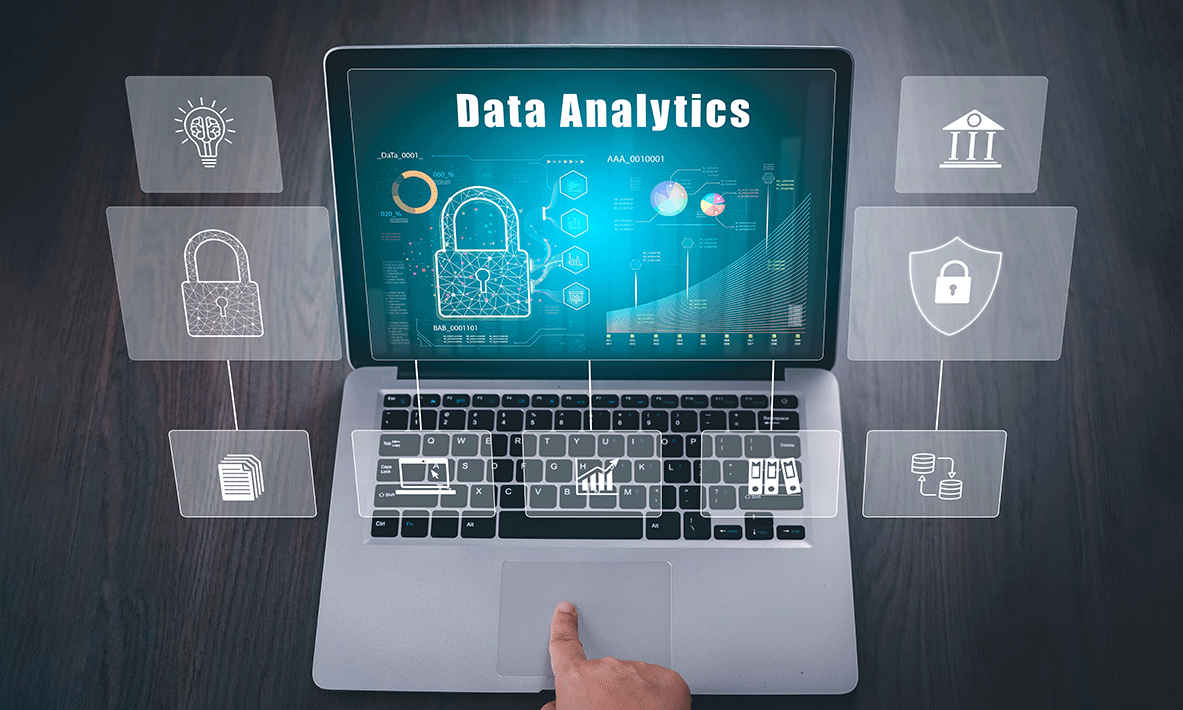

Understanding the Importance of Data Security in Financial Services

Bookkeeping might not be the most glamorous aspect of running a small business, but it is one of the most crucial. Accurate and efficient bookkeeping ensures that your financial records are up-to-date, helps in making informed business decisions, and ensures compliance with tax regulations. Here are five essential tips for small businesses to optimize their bookkeeping and set themselves up for success.

The Critical Role of Data Security in Financial Services

1. Protection of Sensitive Information

Financial services handle a vast amount of sensitive information, including personal identification details, financial transactions, and account data. A breach of this information can lead to identity theft, financial loss, and damage to an individual’s or organization’s reputation. Ensuring data security helps protect this information from

Key Aspects of Sensitive Information:

- Personal Identifiable Information (PII): Names, addresses, Social Security numbers, and other personal details.

- Financial Data: Bank account numbers, credit card details, and transaction histories.

- Confidential Business Data: Strategic financial plans, proprietary data, and confidential communications.

2. Regulatory Compliance

The financial services industry is heavily regulated, with stringent requirements for data protection and privacy. Regulations such as the General Data Protection Regulation (GDPR), Payment Card Industry Data Security Standard (PCI DSS), and others mandate that financial institutions implement robust security measures. Non-compliance can result in severe penalties, legal consequences, and loss of client trust.

Key Regulations for Data Security:

- GDPR: Protects the privacy of individuals within the European Union.

- PCI DSS: Sets standards for securing payment card transactions.

- SOX (Sarbanes-Oxley Act): Requires accurate financial reporting and data protection for public companies.

3. Mitigation of Financial Risks

Data breaches can lead to significant financial losses, both directly through theft and indirectly through legal costs, fines, and reputational damage. Implementing strong data security measures helps mitigate these risks by preventing unauthorized access and minimizing the potential impact of security incidents.

Financial Risks Associated with Data Breaches:

- Direct Theft: Loss of funds or unauthorized transactions.

- Legal Costs: Expenses related to legal action and regulatory fines.

- Reputation Damage: Loss of client trust and potential loss of business.

4. Maintaining Client Trust

In financial services, trust is a key factor in client relationships. Clients expect that their financial data will be handled with the highest level of security. Demonstrating a commitment to data protection not only ensures compliance but also builds confidence and loyalty among clients.

Building Client Trust Through Security:

- Transparent Policies: Clearly communicate data protection practices to clients.

- Regular Updates: Keep clients informed about security measures and updates.

- Incident Response: Have a plan in place to address and communicate any security incidents.

How NextGenFO Ensures the Protection of Sensitive Information

At NextGenFO, data security is a top priority, and we implement a comprehensive approach to safeguard sensitive information. Here’s how we ensure the protection of your financial data:

1. Advanced Encryption Technologies

NextGenFO employs state-of-the-art encryption technologies to protect data both in transit and at rest. Encryption ensures that sensitive information is converted into an unreadable format that can only be deciphered by authorized users with the correct decryption keys.

Encryption Measures:

- TLS/SSL Encryption: Secures data transmitted over networks.

- AES Encryption: Protects data stored on servers and devices.

2. Robust Access Controls

We implement stringent access controls to ensure that only authorized personnel can access sensitive information. This includes multi-factor authentication (MFA), role-based access controls (RBAC), and regular access reviews.

Access Control Measures:

- MFA: Requires multiple forms of verification to access systems.

- RBAC: Limits access based on job roles and responsibilities.

- Regular Audits: Reviews and updates access permissions regularly.

3. Regular Security Audits and Assessments

NextGenFO conducts regular security audits and vulnerability assessments to identify and address potential risks. These assessments help us stay ahead of emerging threats and ensure that our security measures are effective.

Audit and Assessment Practices:

- Penetration Testing: Simulates attacks to identify vulnerabilities.

- Compliance Audits: Ensures adherence to regulatory standards.

- Risk Assessments: Evaluates potential security risks and mitigates them.

4. Incident Response and Recovery Plans

We have a robust incident response plan in place to quickly address and manage any security incidents. This includes clear procedures for detecting, reporting, and mitigating breaches, as well as recovery plans to restore normal operations.

— Strategies

Incident Response Strategies:

Early identification of potential incidents.

Containing and reducing the impact of breaches.

Restoring services and communicating with stakeholders.